Even the best SaaS products can flop without the right go-to-market approach. You might have a sleek interface, a robust backend, and a solid team behind you, but if your SaaS go-to-market strategy is shaky, customers won’t show up. Or worse, they’ll bounce before you can show your value.

Many SaaS founders underestimate the complexity of entering a crowded market. Others get stuck trying to scale with a strategy that never fits their audience in the first place. The truth is that every successful SaaS business wins with clear positioning, smart targeting, and repeatable systems that grow with them.

This guide walks you through what that looks like, step by step. From B2B vs B2C strategy differences to pricing models and real-world case studies, we’ll cover the pieces that matter.

Mastering SaaS Go-to-Market Approaches

In SaaS, getting to market isn’t a phase—it’s a system. And the strength of that system often determines how quickly your product gains traction and how far your business advances.

A smart go-to-market (GTM) strategy aligns your product, marketing, and sales teams around one goal: reaching the right people with the right message at the right time. When that alignment clicks, customer acquisition accelerates, sales cycles shorten, and growth compounds.

SaaS is a fast-moving industry, but it rewards clarity and effective coordination. A strong GTM approach gives you both. It sets the direction, sharpens your focus, and ensures your team isn’t just working hard — they’re working on what matters.

Comparing B2B and B2C SaaS Approaches

B2B and B2C SaaS products live in the same world, but they follow very different rules. Your GTM strategy needs to match the game you’re playing.

- Target Audience: B2B sells to teams, departments, or entire organizations. Buyers care about efficiency, ROI, and how your product fits into existing workflows. The process involves multiple stakeholders, each with their own checklist.

B2C, on the other hand, is a solo act. You’re speaking to individuals who make decisions quickly and emotionally, often based on need, experience, or brand trust.

- Sales Cycle: In B2B, sales cycles are longer and more layered. Think demos, procurement reviews, security checks, and budget approvals. You need to educate, consult, and follow through on your commitments.

B2C moves fast. The decision window is short, and the pitch needs to connect immediately. There’s no room for drawn-out persuasion.

- Decision-Making: B2B deals are often won through a combination of logic, numbers, and long-term value.

B2C depends more on simplicity, usability, and how well the product solves a personal pain point or fits into daily life.

- Strategic Execution: B2B SaaS often runs on account-based marketing, tailored onboarding, custom pricing tiers, and high-touch engagement. Your job is to prove long-term value and show you understand the customer’s business.

B2C relies on mass-market reach, strong content, social proof, transparent pricing, and a frictionless UX.

No matter the audience, success comes from knowing exactly who you’re selling to and aligning your messaging, pricing, and delivery to meet them there.

Why a SaaS Go-to-Market Strategy is Essential

In SaaS, the difference between momentum and missed opportunity often comes down to your go-to-market strategy. You can have a game-changing product, but without a GTM plan that aligns market needs with internal execution, you’re flying blind.

A strong GTM strategy links your product roadmap with actual buyer behavior. It defines how, when, and to whom your solution is introduced—and how you’ll win market share without burning through your budget or your team.

It’s not just a launch checklist. It’s a playbook for scalable growth.

Entering the Market Quickly

Speed matters. SaaS lives on timing, and being late to market means giving competitors a head start.

A tight GTM strategy clears the path for fast, focused product launches. It minimizes friction between product, marketing, and sales so that teams move together instead of tripping over each other.

Here’s how high-performing SaaS organizations accelerate entry:

- Market Intelligence: Validate demand early. Know your customers better than they know themselves.

- Product Readiness: Launch features that solve immediate problems, not future hypotheticals.

- Agile Coordination: Use sprints, cross-functional pods, and real-time feedback loops to stay ahead of shifting conditions.

The goal isn’t to ship fast and fix it later. It’s about shipping smart, building momentum, and capturing early adopters before the noise gets too loud.

Achieving Scalability

Scalability isn’t optional in SaaS—it’s the business model. A GTM strategy built for scale anticipates growth and removes bottlenecks before they happen.

Winning SaaS teams build on these foundations:

- Cloud-Native Infrastructure: Your backend should scale faster than your sales team.

- Automation at the Core: Marketing, sales, and onboarding should run on repeatable workflows powered by data.

- Elastic Support Models: Self-service portals, chatbots, and tiered plans keep costs in check as customer volume rises.

The point of scaling isn’t to add more people—it’s to grow revenue without multiplying complexity.

Maximizing Cost Efficiency

When budgets tighten, your GTM strategy should do the heavy lifting. The best strategies prioritize what moves the needle and cut the rest.

Cost-efficient growth comes from clarity:

- Data-Led Decisions: Track what converts, double down, and cut what doesn’t.

- Lean Execution: Eliminate vanity metrics and bloated ops. Focus your team on channels and tactics that deliver measurable results.

You don’t need a massive budget to win. You need discipline, precision, and a GTM engine that doesn’t waste a dollar.

Boosting Customer Acquisition

Acquiring customers is the lifeblood of SaaS, but doing it efficiently is what keeps you alive.

A focused GTM strategy connects your brand with the right buyers at the right time:

- Segmented Targeting: Build campaigns around real pain points and real decision-makers.

- Personalized Messaging: Speak their language. Show them the problem. Hand them the solution.

- Conversion-Driven Tactics: Optimize for speed to value—trials, demos, onboarding, and quick wins.

In SaaS, your funnel should be as frictionless as possible. Each step should feel like progress, not persuasion.

Strengthening Customer Retention

Acquisition gets the spotlight, but retention is what builds empires. A good GTM strategy doesn’t stop at the sale; it plans for post-sale success.

Here’s how innovative SaaS companies keep customers coming back:

- Proactive Support: Anticipate issues and solve them before they escalate.

- Ongoing Engagement: Keep the product relevant with updates, user education, and thoughtful communication.

- Retention Systems: Loyalty programs, health scoring, and customer success teams that act, not react.

A well-executed GTM strategy turns new users into power users and power users into brand advocates.

Crafting a Winning SaaS Go-to-Market Strategy

A SaaS go-to-market strategy isn’t just your launch plan. It’s the system that aligns product, marketing, and sales with market demand—so your business grows efficiently, attracts the right customers, and keeps them loyal.

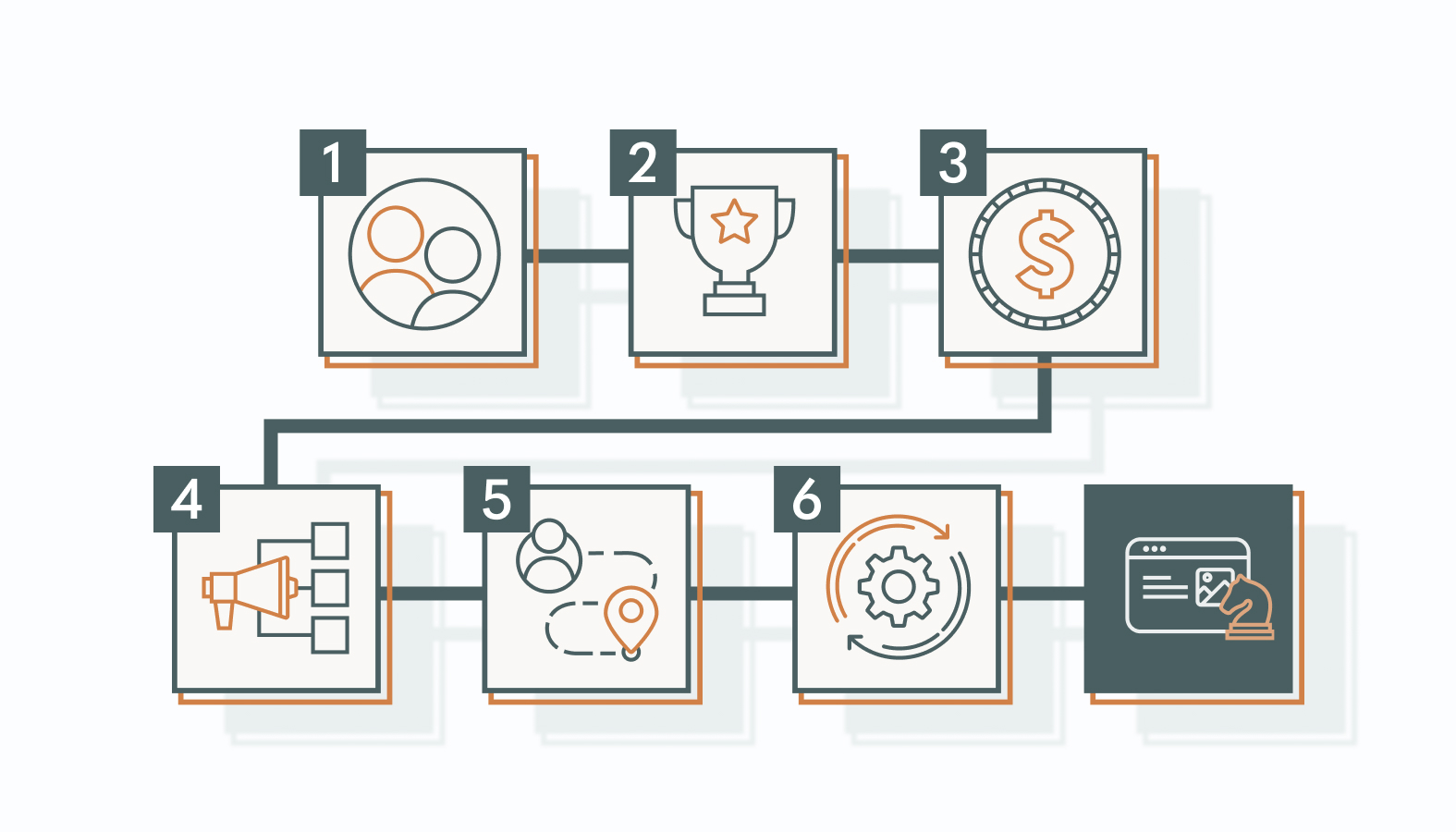

Here’s a step-by-step breakdown of a GTM strategy that gets traction and scales.

Step 1: Get Smart on the Market and Your Customers

The fastest way to waste resources is to build without a clear understanding of the project’s requirements. Market intelligence removes the uncertainty.

- Map the competitive landscape. Identify direct and adjacent competitors. Analyze how they position themselves, what they charge, how they sell, and who they target. Look for white space they’re ignoring.

- Gather customer intelligence. Talk to prospects, not just current users. Uncover how they evaluate solutions, what they’re trying to fix, and what’s frustrating about existing options. Then, validate findings with data.

- Segment strategically. Go beyond surface-level demographics. Group by roles, company size, urgency of need, tech stack, and buying process. Prioritize based on total addressable market (TAM), willingness to pay, and ease of conversion.

Every strong GTM play starts with precise, validated knowledge—because building the right product is half the battle. Getting it to the right people is the other half.

Step 2: Define a Value Proposition That Cuts Through

In SaaS, where products can sound interchangeable, the way you position yours determines who listens.

- Pinpoint your core outcome. What do you help customers do better, faster, or cheaper than alternatives? Frame that outcome in terms they already care about.

- Anchor it to real pain or opportunity. No one buys software for features. They buy outcomes. Connect your value to measurable results: more revenue, fewer errors, faster onboarding, and reduced risk.

- Make it distinct and bold. Your differentiation should be apparent, not buried. Use plain, compelling language that speaks directly to your target segment’s priorities, not vague claims or technical fluff.

If your value prop can’t pass the “why should I care, why now, and why you” test, it won’t hold attention. Nail that, and you’re in the conversation.

Step 3: Build a Sales and Pricing Model That Matches the Market

Your pricing strategy signals value. Your sales approach dictates velocity.

- Choose your pricing model with intent. Subscription, usage-based, tiered, or freemium all have pros and tradeoffs. Align your model with the complexity of your product, the budget dynamics of your buyers, and the onboarding friction you’re willing to absorb.

- Design sales for your buyer’s journey. A self-serve motion might be enough for low ACV deals. However, mid-market and enterprise companies often require consultative selling. Build processes that guide leads from curiosity to commitment, with the right touchpoints at each stage.

- Test early, and adapt fast. Use early customers as pricing labs. Evaluate conversion rates, expansion potential, and CAC recovery. If they’re slow to convert or quick to churn, your pricing isn’t working.

The best pricing doesn’t just capture value; it accelerates it.

Step 4: Launch Targeted Marketing and Scalable Distribution

Awareness without action is noise. This step turns attention into qualified demand.

- Prioritize the proper channels. Focus on where decision-makers actually spend time. Paid search, content syndication, analyst reports, or integration marketplaces—choose based on audience behavior, not just industry norms.

- Build content for every buying stage. Educate, validate, and convert. Case studies, competitor comparisons, and product tours should reduce friction and build confidence as buyers move closer to purchase.

- Expand through partnerships. Tap into a distribution that already exists. Integrate with platforms your audience already uses, co-market with adjacent tools, or build referral pipelines through industry consultants.

Scaling reach doesn’t mean doing more—it means doing what works better and faster.

Step 5: Engineer Customer Acquisition That Converts

Volume means nothing if you’re leaking leads. Conversion is a system, not a sprint.

- Target with precision. Refine messaging by stage: awareness campaigns should hook curiosity while retargeting and email nurtures should address objections and urgency.

- A/B test aggressively. Test headlines, formats, and CTAs across every touchpoint. Watch clicks alongside qualified leads, pipeline contributions, and close rates.

- Remove friction relentlessly. Audit signup flows, demo requests, and onboarding. Eliminate unnecessary steps, speed up response times, and add clarity at every turn.

High-converting funnels are engineered, not assumed.

Step 6: Lock In Long-Term Retention and Expansion

The acquisition might get the spotlight, but retention funds your growth.

- Accelerate time to value. Help users reach that “aha moment” as quickly as possible. Use tooltips, onboarding emails, and human touchpoints where needed to get them over the hump.

- Deliver proactive customer success. Don’t wait for support tickets. Monitor product usage, offer success reviews, and preempt churn risks with personalized guidance.

- Fuel expansion with insights. Track behavior patterns to uncover upsell triggers. If power users keep hitting a feature limit, that’s not a problem—it’s a revenue opportunity.

The longer you keep a customer, the more valuable they become. And the more they trust you, the easier it is to grow together.

Insights from Top SaaS Companies: Real-World Examples

Top SaaS companies didn’t stumble into growth. They engineered it through GTM strategies that lowered friction, amplified adoption, and stayed in sync with how users actually buy, behave, and expand.

Below are five companies that didn’t just find product-market fit; they built engines for scalable, repeatable success.

How Dropbox Used a Freemium Model to Succeed

Dropbox changed the game by making cloud storage feel effortless—and free. Its freemium model wasn’t a giveaway; it was a precision move. By eliminating the upfront cost, Dropbox drove rapid adoption among individuals who didn’t have to request budget approval. Once they were in, the value became self-evident.

The product handled the heavy lifting. Referrals amplified the reach. And a significant portion of users eventually upgraded to paid tiers for more storage and collaboration tools. Freemium wasn’t just an acquisition play—it was a structured pipeline that turned free users into long-term revenue.

Key takeaway: Reduce initial commitment friction, then design a value path that leads users from activation to monetization.

Slack’s Path to Becoming a Collaboration Powerhouse

Slack didn’t try to out-shout competitors. It quietly embedded itself into workflows by solving real collaboration headaches and integrating with the tools teams already used. Rather than guessing what users wanted, Slack paid attention to how they actually used the product, through behavior, feedback, and data.

This constant feedback loop turned users into co-creators. It also meant that Slack was always one step ahead of the market, refining its UX, expanding integrations, and launching features before the competition even recognized the gap.

Key takeaway: Ship fast, listen hard, and let your users shape what’s next. The closer you are to their needs, the quicker you scale.

Zoom’s Flexible Pricing Strategy for Growth

Zoom didn’t win the video wars by having the best tech on paper. It won by being the easiest to access—and the hardest to outgrow. With flexible pricing and a rock-solid free tier, Zoom gave everyone from solo users to global enterprises a way to try, trust, and then expand.

When remote work surged, Zoom didn’t need to pivot. It was already positioned with pricing that scaled by usage, features, and team size. That flexibility turned urgency into adoption, and adoption into lasting loyalty.

Key takeaway: A flexible pricing strategy lets you meet users where they are, and then grow with them without friction.

HubSpot’s Mastery of Inbound Marketing

HubSpot didn’t just market software. It educated a generation of marketers. Its inbound strategy was a long-game play: create high-value content that solves real problems, then pair it with tools that help users act on what they just learned.

From blog posts and templates to complete certification programs, HubSpot positioned itself as a trusted authority. This content wasn’t an add-on. It was the engine that drove traffic, nurtured leads, and created high-intent customers who already understood the product’s value before the first demo.

Key takeaway: Educate first, sell second. When prospects learn from you, they’re more likely to buy from you—and stay.

Spotify’s Focus on User Engagement and Retention

Spotify didn’t rely solely on a catalog. It turned user data into curated experiences. From Discover Weekly to algorithmic playlists, Spotify personalized music in a way that made each user feel like the platform knew them.

That relevance kept users coming back. Add in a free trial funnel, frequent feature releases, and a UX that made discovery effortless, and Spotify built more than a music app—it built a habit.

Key takeaway: Personalization isn’t a feature. It’s a retention lever. Use data to make your product feel indispensable.

What These Companies Got Right

These SaaS leaders took different paths, but their strategies shared a few things in common:

- They removed friction from the first interaction

- They designed for scale without losing touch with user needs

- They built trust through content, support, or product experience

- They adapted pricing and product design to meet a wide range of user journeys

GTM success isn’t luck. It’s smart systems, sharp insight, and constant iteration. If you’re building—or rethinking—your GTM strategy, these aren’t just stories to admire. They’re proven plays worth adapting.

GTM Strategy Pitfalls That Sabotage Growth (And How to Avoid Them)

A solid go-to-market strategy can create serious momentum. However, even great products can stall when execution falls into common traps. If you’re heading to market, here are four mistakes to sidestep—and how to fix them before they derail your launch.

1. Skipping the Hard Work: Incomplete Market Research

If your market research starts and ends with gut instinct or a Google search, you’re flying blind. Without data-backed insights, you’re guessing who your buyers are, what they care about, and how they make decisions.

Savvy companies go deeper:

- Customer Interviews & Surveys: Not just vanity feedback. Honest conversations uncover pain points and motivators.

- Behavioral Analytics: Heatmaps, conversion paths, churn reports—they show what people actually do, not what they say.

- Competitive & Industry Data: Look for whitespace, pricing gaps, messaging weaknesses, and positioning opportunities.

Market research isn’t homework. It’s the blueprint for GTM clarity. Miss this step, and you risk building something no one needs.

2. Misfiring on Your Target Audience

You can’t sell to everyone. And trying to burn your budget and team out faster than a buggy onboarding flow.

The solution? Precision.

- Define Real Buyer Personas: Not vague labels like “Marketing Manager.” Focus on specific roles, use cases, pain points, and purchasing power.

- Use First-Party Data to Refine: Don’t just guess. Analyze CRM behavior, sales conversations, and demo requests to tighten your segmentation.

- Match Positioning to Stage of Awareness: Someone discovering the problem needs a different pitch than someone actively comparing tools.

Targeting the wrong audience is more expensive than targeting none at all. Dial in your ICP early, and everything else gets easier — from messaging to media spend.

3. Weak Value Proposition That Doesn’t Stick

If your value prop sounds like it came off a SaaS bingo card (“all-in-one,” “seamless,” “end-to-end”), it won’t win deals. Buyers want clarity. They want outcomes.

To build a value proposition that cuts through:

- Lead With the Outcome: Save time? Cut cost? Boost retention? Say it in plain terms, then prove it.

- Differentiate or Die: If your biggest competitor could use your headline, rewrite it.

- Use Customer Language: Pull phrasing straight from calls, reviews, and support tickets. Mirror their pain, and you’ll earn their attention.

A sharp value proposition gives your GTM team a magnetic core. It focuses campaigns, fuels sales conversations, and reinforces pricing power.

4. Poorly Structured Pricing and Sales Strategy

Misaligned pricing can kill deals before they even begin. Too high, and you lose entry-level buyers. Too low, and you repel enterprise. Meanwhile, clunky sales processes add friction where there should be flow.

To tighten this up:

- Test Multiple Pricing Models: Flat rate, tiered, usage-based, per-seat—each attracts a different segment. Let your audience tell you what makes sense.

- Align Sales Strategy With How People Buy: Self-serve for low ACV. Human touch for complex deals. Blend product-led growth with high-touch service where it counts.

- Map the Buyer Journey: Identify where friction occurs—from the landing page to the final signature—and eliminate it.

Strong GTM teams don’t just sell hard. They sell smart. Structure your offer, motion, and pricing to meet the market where it already is.

Avoiding GTM pitfalls requires a mindset shift; not just better tactics. The best teams stay curious, course-correct fast, and treat go-to-market like a living system. Lead with insight. Build an engine that moves with precision.

Build the Engine, Don’t Wing the Launch

A high-performing SaaS go-to-market strategy isn’t a one-time launch plan. It’s the system that aligns your product, marketing, and sales around the customer, so you move faster, close better, and scale without chaos.

Winning teams don’t guess their way into growth. They build with precision, iterate on real data, and remove friction before it stalls momentum.

If you want sustained traction, you need more than a polished pitch and a GTM strategy that flexes with the market, adapts to customer behavior, and positions your product as the obvious choice.

From sharp positioning and pricing to post-sale retention and expansion, this system is your growth engine. Get it right, and your SaaS business won’t just grow. It’ll compound.

Ready to Tighten Your GTM Strategy?

If you’re looking to stress-test your current GTM approach or want a fresh perspective from a team that’s been in the trenches, we’re game.

Schedule a candid conversation with one of our experts. We’ll cut through the noise, spotlight your blind spots, and help you turn your go-to-market motion into a scalable, repeatable engine. No fluff. Just clear insight and practical advice tailored to your goals. Let’s talk.