Most businesses obsess over revenue, leads, and conversions, but can’t figure out why growth feels so slow or why marketing spend sometimes falls flat. The benefits of customer lifetime value (CLV) provide solutions to those challenges.

Instead of chasing short-term wins, it helps reveal which customers drive long-term results and where your efforts deliver the biggest payoff.

When teams ignore CLV, decisions are unclear, budgets drift toward noise, and opportunities slip away. When understood and applied, CLV boosts focus, aligns priorities across marketing, product, and retention, and turns customer insights into a great working strategy.

This guide will break down what CLV means, how top brands leverage it to their advantage, and where many businesses stumble. Stick with us, and you’ll discover why CLV deserves a leading role in every serious business plan.

Unlocking the Value of CLV

In a crowded market, Customer Lifetime Value (CLV) gives leaders a longer view, helping them understand how customer relationships perform over time. Teams can even plan with more confidence and align efforts around customers who deliver consistent return on investment.

When CLV is measured well and applied accordingly, it reshapes how businesses think about engagement, retention, and investment. Marketing becomes more precise, customer experience gains direction, and strategy starts to reflect reality rather than assumptions. The result is a clearer sense of where to focus and why it matters.

Defining Customer Lifetime Value

Customer Lifetime Value, or CLV, estimates the total net profit, or margin contribution, that a customer is likely to generate during their relationship with a business. A true CLV calculation accounts for factors such as how often customers buy, how much they spend, and the cost to serve them. This provides a clearer view of long-term profitability.

It connects past behavior with future expectations. By combining average purchase value and frequency, customer lifespan, and the associated margins, businesses gain a practical forecast that supports smarter planning and more relevant outreach.

Why Customer Lifetime Value Matters

CLV adds context to decision-making. It helps teams separate high-impact customers from low-return activity and adjust strategy accordingly, such as refining targeting, adjusting service levels, or prioritizing certain segments.

Over time, this focus strengthens margins and steadies growth. Companies that pay attention to CLV tend to allocate resources with more discipline, respond faster to changes in customer behavior, and build strategies that work best beyond the next quarter.

Benefits of Customer Lifetime Value (CLV)

Understanding Customer Lifetime Value and using it well is your advantage. When CLV is actively applied, it gives teams a clearer sense of where to focus, how to prioritize effort, and which decisions pay off over time. Businesses can operate with intent and discipline.

In practice, mastering CLV helps organizations:

- Improve customer retention by identifying which relationships are worth greater investment.

- Refine segmentation so messaging, offers, and service levels feel more relevant.

- Allocate marketing spend with higher confidence and less waste.

- Inform product decisions using real customer behavior.

- Increase profitability through smarter engagement across the customer lifecycle.

1) Improving Customer Retention Rates

CLV highlights customers who consistently contribute the most value over time, which makes retention more focused and effective.

- Teams can tailor outreach, service, and incentives based on actual customer value.

- Retention programs are more precise, since resources are aligned with long-term contribution.

From a financial standpoint, retaining the right customers results in returns.

- Higher retention leads to steadier revenue and lower pressure on acquisition spend.

- Strong customer continuity supports healthier margins and predictable performance.

When CLV guides retention, effort produces lasting returns rather than short-lived wins.

2) Strengthening Customer Segmentation Strategies

CLV adds depth to segmentation by tying behavior to long-term outcomes beyond the demographics or recent actions.

- High-value segments become easier to identify and to prioritize.

- Messaging and offers can be shaped around patterns that signal sustained engagement.

This approach improves relevance without adding complexity.

- Campaigns feel more intentional, and response rates reflect clarity.

- Teams gain a better understanding of which segments deserve ongoing attention.

CLV-driven segmentation helps businesses focus more on meaningful and long-term impact.

3) Improving Marketing Budget Allocation

CLV helps marketing teams decide where to spend and where they shouldn’t.

- Budgets can be directed toward channels and campaigns that attract higher-value customers.

- Performance reviews focus on long-term contribution rather than surface-level metrics.

Over time, this discipline sharpens returns.

- Spend becomes easier to justify, defend, and adjust.

- Marketing efforts align more with business outcomes that matter.

With CLV guiding budget decisions, marketing becomes an investment strategy.

4) Informing Product Development Decisions

CLV data offers insight into what loyal customers value and continue to pay for.

- Product teams can prioritize enhancements that support long-term usage and satisfaction.

- Feedback from high-value customers carries clearer strategic weight.

This alignment reduces risk.

- Development efforts are grounded in proven demand.

- Products improve in ways that support retention and sustained revenue.

CLV helps product teams build not with assumptions but with purpose.

5) Supporting Profit Growth

CLV ties customer strategy directly to financial performance.

- Higher-value relationships receive appropriate attention across marketing, service, and product.

- Engagement strategies become more deliberate and less reactive.

When CLV is revisited and refined over time, results tend to follow.

- Churn decreases, revenue steadies, and profitability becomes easier to manage.

- Businesses maintain momentum without relying on constant acquisition pressure.

Profit growth becomes more reliable when it’s driven by customer value.

How Businesses Put CLV Benefits into Action

The advantages of CLV show up when teams apply focused strategies that strengthen customer relationships and reinforce long-term engagement. These approaches translate CLV insights into day-to-day execution without adding unnecessary complexity.

Growing Repeat Customer Behavior

Encouraging repeat purchases is one of the most direct ways CLV delivers value.

When businesses apply personalized outreach, loyalty incentives, and consistent service standards, customers usually return. Over time, repeat behavior supports steadier revenue and lowers the cost of maintaining growth.

Strengthening Early Customer Experiences

The onboarding phase shapes how customers perceive value from the start.

Clear guidance, support, and fast time-to-value reduce early drop-off and set expectations for an ongoing relationship. When onboarding is aligned with CLV goals, retention becomes more predictable.

Maintaining Ongoing Customer Relevance

CLV benefits compound when customers continue to see value beyond the initial engagement. Regular updates, clear communication, and responsive improvements keep relationships active. Brands that maintain relevance over time hold attention longer and a greater share of spend.

When these strategies are executed with focus, CLV stops being an abstract metric and becomes a practical tool that guides decisions, aligns teams, and supports sustained growth. From here, we can look at how leading brands put CLV into practice with remarkable results.

Practical Uses of CLV in Business

Customer Lifetime Value becomes very useful when it moves out of theory and into daily decisions.

Leading companies don’t treat CLV as a static metric, as they use it as a reference point for experience design, investment planning, and long-term focus. The result is a strategy that feels more intentional than reactive.

Looking at how established brands apply CLV shows what’s possible when customer data guides action. Each example highlights a different way CLV can shape priorities, influence decisions, and support steady growth without overcomplicating the model.

Amazon’s Success with CLV

Amazon applies CLV by paying close attention to how customers behave over time and then removing friction wherever possible. Every interaction is designed to feel relevant, efficient, and easy, which encourages repeat behavior without needing heavy persuasion.

- Purchase history and browsing behavior inform personalized product suggestions.

- Convenience features reduce effort and increase the likelihood of repeat purchases.

Programs like Prime reinforce this approach by encouraging ongoing engagement besides one-time transactions.

- Membership benefits reward consistency and increase long-term spending.

- Customer experience decisions align closely with sustained usage patterns.

Takeaway: Amazon uses CLV to prioritize convenience and relevance to keep customers coming back without needing constant promotion.

Netflix’s Strategic CLV Implementation

Netflix applies CLV by focusing on sustained engagement rather than short-term view counts. Content strategy is shaped by how subscribers interact over time, not by isolated spikes in attention.

- Viewing behavior helps identify which content keeps subscribers engaged longer.

- Recommendations adjust continuously as preferences change.

CLV influences where Netflix places its content investment. For example, it helps determine which original series deserve massive multi-season commitments, indicating high-CLV content, not low-investment experimental content.

- Data guides decisions on renewals, originals, and long-term series development.

- Resources are directed toward content that supports retention instead of initial interest.

Takeaway: Netflix uses CLV to align content strategy with viewer longevity, which supports retention while keeping the platform relevant.

Starbucks’ Approach to CLV

Starbucks applies CLV through consistent engagement and data-informed loyalty experiences. Instead of relying heavily on broad promotions, it uses customer behavior to shape how and when it interacts with individuals.

- Purchase patterns guide personalized offers and rewards.

- Mobile ordering and loyalty features reinforce habitual use.

The loyalty program acts as both an engagement tool and a feedback loop.

- Repeat behavior is encouraged through meaningful incentives.

- Data collected supports ongoing refinement of the customer experience.

Takeaway: Starbucks uses CLV to turn everyday purchases into long-term relationships built on habit and convenience.

These examples show that CLV doesn’t require complexity to be effective. When applied with focus and intent, it becomes a practical guide for smarter decisions across the business.

Overcoming CLV Challenges

Customer Lifetime Value offers meaningful direction. Applying it consistently is where many organizations hit resistance.

The challenge is understanding CLV more than in its theory, and building the discipline and infrastructure required to use it well over time. When these obstacles are addressed early, CLV becomes more reliable as a decision-support tool rather than an occasional reference point.

Efficient Data Collection and Analysis

CLV depends on clean and connected data. When customer information is fragmented across systems or poorly maintained, the resulting insights can distort planning and slow decision-making. Reliable CLV analysis starts with consistent data practices that bring customer behavior, transactions, and engagement into a single, usable view.

Modern tools reduce this friction. However, technology alone isn’t enough. CRM platforms, analytics solutions, and automated reporting only deliver value when teams align on definitions, inputs, and ownership. When data flows smoothly and is reviewed regularly, CLV becomes easier to trust and act on.

Adapting to Evolving Customer Preferences

Customer behavior rarely stands still, and CLV models keep pace. Preferences shift, usage patterns change, and expectations rise, often faster than planning cycles to account for. If CLV assumptions remain stagnant while customers move forward, insights lose relevance.

Staying responsive requires ongoing listening and timely analysis. Feedback signals, usage trends, and performance data should be revisited often enough to reflect current behavior. When CLV strategies match customer expectations, businesses don’t have to continue relying on outdated projections.

If handled well, these challenges won’t weaken CLV. They strengthen it. When data stays reliable, and assumptions stay current, CLV continues to provide steady guidance even when conditions change.

Incorporating Customer Lifetime Value (CLV) into Your Business Plan: A Step-by-Step Process

Integrating Customer Lifetime Value (CLV) into your business plan is an analytical exercise and a shift in mindset. Focus on sustainable growth by understanding which customers drive real value instead of chasing short-term wins.

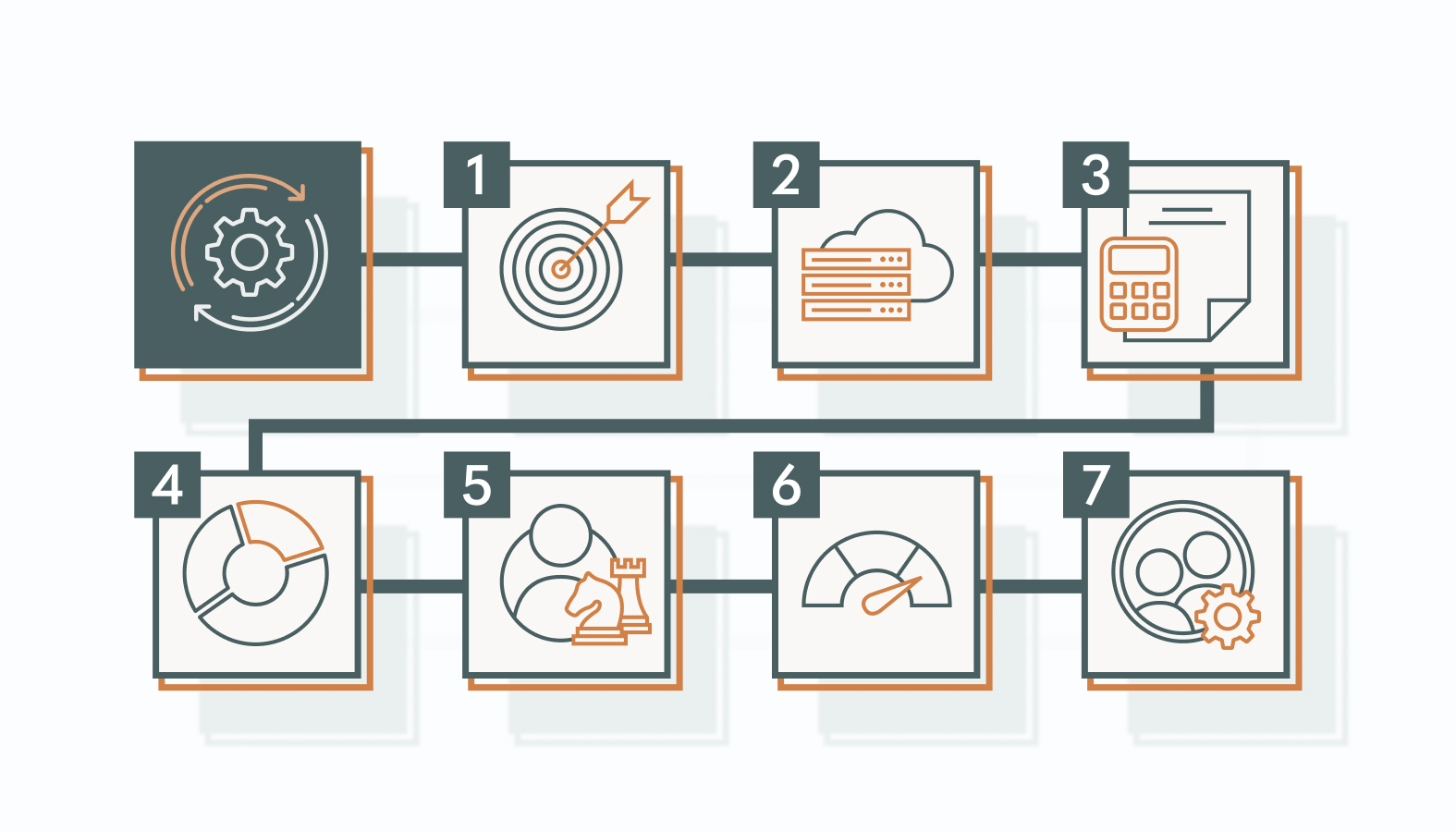

Here’s a step-by-step roadmap to make CLV an actionable part of your strategy.

Step 1: Define Your Objectives

Start by clarifying what you want CLV to achieve in your business plan.

Are you aiming to improve retention, refine marketing spend, or guide product development?

Set clear goals to ensure that CLV insights will inform decisions instead of just producing another spreadsheet.

Step 2: Collect and Clean Your Data

CLV should be as good as the data behind it. Gather purchase histories, transaction frequency, average order value, and customer engagement metrics.

Ensure data is accurate, organized, and consolidated across departments. Investing time here prevents misleading insights later.

Step 3: Calculate CLV

There are several ways to calculate CLV, from basic to predictive models.

A simple approach multiplies (Average Purchase Value x Purchase Frequency x Customer Lifespan) x Average Gross Margin.

More advanced models factor in churn probability, customer acquisition cost, and net present value.

Step 4: Segment Your Customers

Once you have CLV scores, categorize customers into high, medium, and low-value segments. This segmentation enables targeted strategies like rewarding loyal customers, nurturing mid-tier clients, and understanding why lower-value segments behave differently.

Step 5: Align Strategy and Resources

Integrate CLV insights into your business plan by linking them to actionable strategies.

Allocate marketing budgets where high-value customers like to engage.

Shape retention programs and loyalty initiatives based on segment behavior. Even product development decisions can reflect the preferences of your most profitable customers.

Step 6: Monitor, Refine, Repeat

CLV isn’t static. Track performance, test interventions, and adjust assumptions regularly.

As customer behavior changes, so should your strategies. Regularly revisiting CLV ensures your plan stays relevant and your resource allocation remains clear.

Step 7: Communicate Insights Across Teams

Finally, embed CLV into the culture. Share insights with marketing, product, and customer success teams. When everyone understands where the value lies, decisions across the organization become more intentional, efficient, and profitable.

Driving Business Growth with CLV: Strategic Takeaways

Mastering Customer Lifetime Value is a competitive edge. Understanding which customers generate the most value over time, businesses can make informed decisions that strengthen retention, optimize marketing spend, and fuel sustainable profitability.

The key to CLV, aside from measurement, is consistent application. Refining CLV strategies, adapting to evolving customer behaviors, and embedding insights across teams transforms CLV from a metric into a strategic compass. Companies that do this gain efficiency, precision, and a loyal customer base that drives momentum year after year.

CLV is a dynamic tool for navigating today’s market and shaping tomorrow’s success. Businesses that integrate it lead.

Take Control of Your CLV Strategy

Customer Lifetime Value has the power to upgrade your business, turning customer insights into actionable growth strategies. If you’re ready to stop guessing and start making decisions that work effectively, our team is here to help.

Schedule a candid conversation with one of our experts » and discover how to utilize CLV to improve retention, sharpen marketing efforts, and drive sustainable profitability. We’ll break down your challenges and show you the path to lasting growth and predictable returns.